Financial services teams have a lot on their plate. Not only are they managing branches across the country (and beyond), providing outstanding customer service, and retaining brand identity across locations, they’re complying with stringent industry regulations and handling sensitive customer data too. A good way to ease the load and support your busy teams is with a financial services intranet.

What are the benefits of a financial services intranet?

Intranet solutions provide finance teams with a suite of productivity tools that make their day-to-day job easier. With a modern intranet on your teams’ side, they’ll experience benefits such as:

- Time savings: With a financial services intranet, all documents and internal communications are centralised in one place. This will save your teams’ time by reducing the need to search through endless emails or folders for the relevant information.

- Remote working capabilities: Cloud based intranets remove the requirement to be tied to a desk to get work done. Instead, staff can work from anywhere – all they need is a Wi-Fi enabled mobile device to connect to the intranet.

- A tighter company culture: A financial services intranet includes company culture-boosting tools – such as collaboration spaces and communications channels – that will bring teams together and break down departmental silos.

If you’re in the early stages of planning your financial services intranet strategy, it’s important that you consider which tools will be most valuable to your teams and relieve some of the pressure. Below we outline the essential features your financial services intranet must have:

6 essential features of an intranet for financial services

1. Content-rich employee directory

With dispersed branches, office-bound teams, remote staff, and field workers based up and down the country, it can be difficult to put a face to a name and know exactly who to contact and how.

Financial services intranets contain customisable user profiles that bring team members’ details to life. Much more than just a static employee directory, content-rich user profiles allow staff to personalise their own area of the intranet. In addition to contact details, team members can add information about their hobbies, communication styles, and career background, as well as endorse each other for particular skills and share kudos. If staff have won any digital awards, they can promote them on their user profile like a virtual trophy cabinet.

2. Secure and easy access to documents

Relying on email for document management is problematic, not least because it poses security threats. It also wastes time by increasing the risk of staff using the wrong version of a document, which could impact everything from providing customers with incorrect information to following out-of-date financial regulations.

Keeping sensitive documents secure is easy when you have a financial services intranet, which includes robust document management software as standard. Complete with granular access controls – which allow you to restrict who can and can’t view certain files – a document management system is a secure gateway for staff to obtain the information they need.

By centralising your business-critical files in one location, teams will know exactly where to find the most up-to-date and accurate version of each document.

3. Employee communication tools

Keeping branch workers connected to the goings on at head office – and vice versa – is an ongoing challenge. A financial services intranet provides a variety of employee communication tools that unify your teams and make sure everyone is well informed about the wider business goals.

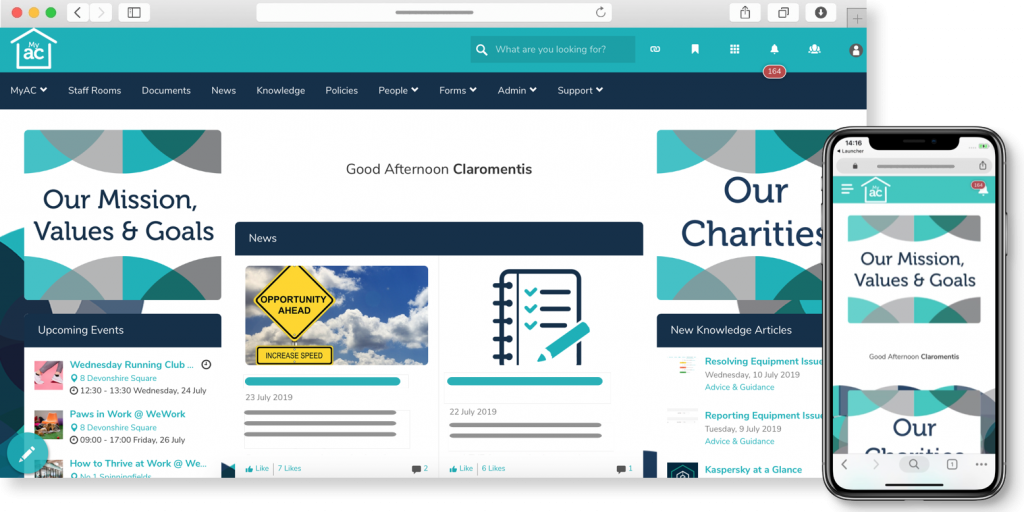

For example, you can easily share company updates across the entire organisation using your intranet news app, keeping everyone in-the-know regardless of where they work. If you need to send an urgent announcement to specific teams – such as a particular branch, for instance – you can push notifications directly to their intranet mobile app.

4. A great user experience

The importance of a great intranet user experience shouldn’t be underestimated – it’s the key to user adoption and ongoing employee engagement with the system.

A financial services intranet should therefore include content management tools that allow you to put your own stamp on the software.

Targeted content areas, an on-brand and customisable intranet design, and easy-to-use intranet apps all add up to providing an engaging user experience for your finance teams.

5. E-forms and workflows

Nothing saves time and improves processing power quite like e-forms and workflows software. It works by turning your manual admin and paperwork into an automated business process that ticks over in the background with minimal human input.

For example, busy finance teams may need to process hundreds of invoices and purchase orders a week, taking up valuable time that could be channelled into more strategic and innovative initiatives. E-forms and workflows software can be used to handle the repetitive parts of these processes, such as automatically assigning invoices to the relevant team members and archiving them after approval.

Capturing this data digitally via e-forms also improves accuracy, because it reduces the human error that’s commonly associated with processing paperwork manually. If there are any queries further down the line, staff can quickly search the database of invoice or purchase order requests to locate the information they need, rather than rifle through stacks of paper forms.

6. Policy management tools

As we mentioned above, financial services teams are bound by strict regulations that are constantly evolving, and these impact everyone from HQ to the frontline.

A policy management tool, therefore, is an essential feature of your financial services intranet. It simplifies the policy management process by centralising all of the key regulations in one place, so teams know exactly where to find the latest updates.

From a compliance perspective, policy management software provides complete transparency on who has and hasn’t read and accepted a policy through read receipts. This will be indispensable for senior management, who need to ensure their teams are armed with the latest knowledge about industry regulations.