Financial services companies handle a wealth of confidential customer information and must scrupulously maintain records of all transactions and communications for years with the information needing to be shared quickly and easily with authorized employees. Still, many businesses in the industry doggedly rely on paper-based processes that are prone to errors and easily lost in vast siloes of data. As well as being incredibly inefficient, these processes are potentially insecure.

If your business operates in the financial services sector a financial intranet - available on-premise as well as cloud based - offers many benefits which, in this article, we’ll outline.

4 benefits of an intranet platform for Financial Services

1. Enhanced speed and efficiency

A dedicated intranet enables companies that provide financial services to increase the speed and efficiency of their customer service. With all business data stored in a single centralized location, staff members can quickly and easily access the resources they need to respond promptly and accurately to customers’ enquiries. An intranet platform for financial services also ensures that staff receive real-time notifications about incoming customer requests so that no enquiries go unnoticed or unanswered.

Also, customized workflows and e-forms reduce the time needed to complete manual tasks, such as mortgage applications or purchase order requests. By streamlining business processes and minimizing response times, financial services companies can enhance their customer service, thereby securing the long-term loyalty of customers.

2. Up-to-date and centralized data

Compliance is essential in the financial services industry, with punishing sanctions for inaccurate advice or information. By implementing a financial intranet, businesses can improve the storage, management, and dissemination of data to provide staff with the most up-to-date information and eliminate the risk of giving customers misleading or incorrect advice.

With a reliable and centralized data repository, financial services companies can enhance their operational efficiency and minimize errors, showing themselves to be trustworthy and credible.

3. Enhanced data security and privacy

Data security and privacy are paramount in the financial services industry as a data leak can be extensive. An intranet allows companies to maintain strict control over customer data, ensuring that only authorized personnel can access sensitive information. When combined with robust security measures, such as user authentication protocols and data encryption, financial services companies can safeguard customer data and prevent unauthorized access.

By making data security and privacy a priority, financial companies can build trust with their customers and comply with demanding regulatory requirements.

4. Targeted staff training and knowledge sharing

An intranet serves as a valuable platform for staff training and knowledge sharing within financial services companies. Up-to-date knowledge and skills are vital in an industry that is constantly evolving, so professional development modules and resources can be created and made accessible to employees to ensure they are well-placed to serve customers effectively and comply with regulatory requirements.

By providing targeted and up-to-date training, companies can enhance their service capabilities and ensure that customer information is handled with care, avoiding data breaches or privacy concerns.

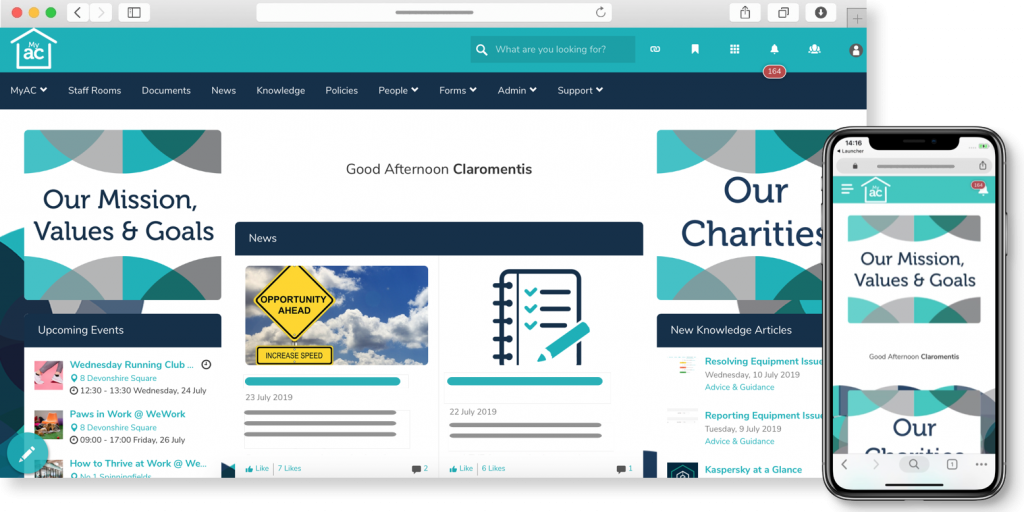

Contact us for a branded intranet demonstration

The best way to see the benefits of an intranet for financial services is to arrange a branded demonstration of the Claromentis platform. To book your personal tour, please contact us today.