When asked to name their top strategic focus of the next 12 months, 58% of credit unions answered ‘improving digital customer engagement’.

This should come as no surprise. With competition more fierce than ever before, credit unions must find new methods to attract and retain their members. Beyond offering competitive interest rates and perks, improving digital experiences is one surefire way to secure top of wallet status.

The difficulty, of course, is knowing where to start.

In this article, we’ll highlight 4 ways digital transformation—and the right digital workplace platform—can help you deliver superior experiences to your members.

Understanding changing consumer expectations

As it stands, 77% of interactions with members and prospects happen digitally, with over a third of all interactions taking place via mobile applications.

In other words, most credit unions already offer some form of digital service. Customers have come to expect this.

What makes a digital transformation truly transformative is how you blend these services with user experiences. Before you can hope to do this, you’ll need to dig deeper into changing consumer habits and needs.

Consider the following:

- 84% of credit union customers research a product online before applying.

- Security and trust is the top factor for consumers when choosing a credit union, followed by digital capabilities and user experience.

- 68% of consumers abandoned digital banking applications after experiencing a bad onboarding experience.

- 49% of banking customers dislike filling out paper forms or sending documents in the post.

- 67% of people expect same-day processing for insurance applications.

4 digital transformation strategies that will enhance credit union member experience

Bearing these statistics in mind, let’s now explore how you can satisfy these needs with the help of transformative digital technology.

1. Understand your members’ needs

What do the citizens and businesses in your community really care about? And how can you satisfy those needs?

To get a better understanding of what makes your members tick, conduct regular research and provide opportunities for feedback.

With the help of a digital workplace platform, you can collect this feedback in a number of ways:

- Surveys. Digital surveys are a great way of gathering quantitative and qualitative insights into consumer habits. For instance, you may send a survey to a new member after their onboarding process is complete, asking them to rate their experience. Alternatively, you could distribute a financial wellness survey to your existing members with the aim of gathering information about budgeting, debt, and saving habits—all of which may inform your future services, resources, and marketing efforts.

- Polls. To get more succinct opinions, distribute polls to your membership base. For instance, would they be interested in a unique holiday savings account? Or an exclusive Christmas loan to help them mitigate some of the costly expenses of the holiday season?

- Idea generation. It’s also worth encouraging your members to suggest ideas of their own. Creating a quick ‘idea box’ e-form is a great way to collect these insights throughout the year and ensure they get passed on to your team members.

- User analytics. Lastly, monitor user analytics, audit logs, and content interactions across your touchpoints to understand what services, products and communications garner the most interest.

These insights are fundamental to your digital transformation efforts going forward. With concrete data to hand, you can develop and improve your services without risk.

2. Provide seamless, secure, and competitive online services

As research suggests, your members want the right information delivered to them in a quick, secure, and personable way. It’s all about convenience.

This means offering easily accessible services, such as:

- Mobile applications. Remember, a third of all credit union interactions happen via mobile apps. So make sure your website and customer portals are mobile friendly and work soundly with your other touchpoints.

- Personalized experiences. Consumers value product recommendations that align with their unique needs—whether its bank accounts with low currency conversion charges for freelancers, or bespoke savings accounts. Collecting and analyzing customer data is key to facilitating these types of services. However, you can also harness roles and permissions settings on your customer portals, too. This allows you to personalize experiences and promote content, pages and helpful resources that match your members’ needs.

- Self-service options. Waiting on hold for a financial advisor to answer the phone can be frustrating to say the least. It’s far more convenient for everybody involved to offer self-service alternatives. This empowers your members to apply for products and/or request support at a time that suits them.

- Automated onboarding experiences. Your members expect a fast and efficient onboarding experience. This is where automated e-forms and workflows can really augment your efforts. With status updates, notifications, task assignment, and information capture, your teams will have everything they need to get your members up and running quickly.

3. Embrace a “phygital” approach

Yes, digital is the way forward. But that doesn’t mean you should disregard your physical services.

Around 80% of consumers prefer to speak with a human when making decisions around taking out a loan, mortgage, or insurance policy. What’s more, access to a financial advisor is 29% more likely to trigger an investment decision compared to other factors, such as mobile support and planning tools.

As such, it’s important to provide opportunities for human interaction alongside your digital services. This may be as simple as creating a ‘book an appointment’ e-form, where members can explain their current financial needs and request personalized advice from an expert in person or over the phone.

4. Enable effective, timely communication between teams

The customer experience doesn’t begin with your customers. It begins with your employees.

If communication is poor between your team members, this will trickle down to your customer interactions. Members may end up having to repeat information to multiple employees—which can significantly impede their experience.

This is clearly a sticking point for many financial services organizations. Indeed, according to a recent IBM report, 42% of banks rank ‘time management skills and the ability to prioritize’ as their top skills priority. This is closely followed by the ability to work in teams (40%) and the ability to communicate effectively (38%).

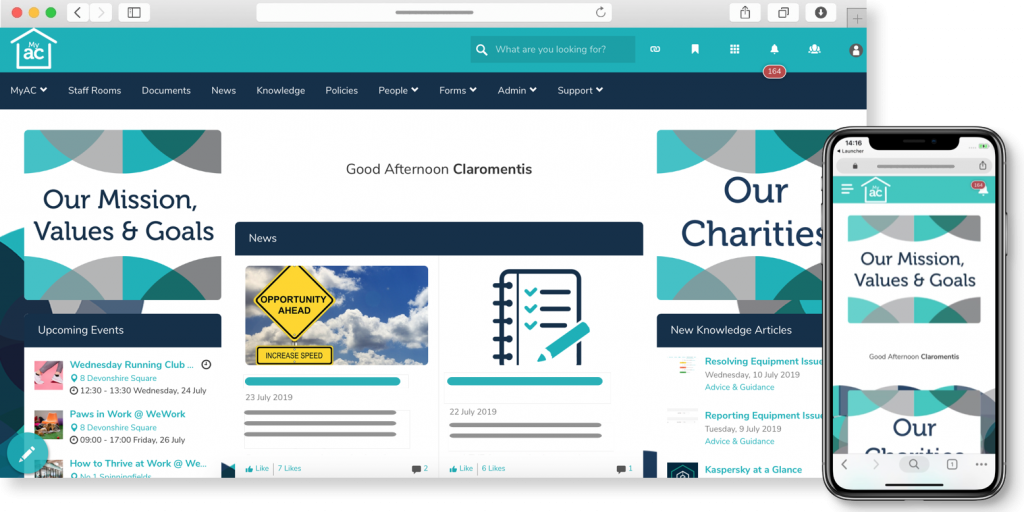

To boost communication and knowledge sharing, centralize all your product, customer, and project information in one secure digital workplace platform. A solution like Claromentis acts as a single source of truth. Employees can access up-to-date data and collaborate with their colleagues in real time, ensuring everyone’s on the same page.

This not only increases service quality and process compliance, but can help you to deliver a seamless omnichannel member experience.

Embarking on your credit union digital transformation with Claromentis

As it stands, only 50% of credit unions have reached a mature state of digital transformation.

This isn’t due to a lack of trying. Credit unions face a number of challenges that can make digital transformation complex. According to Wipfli’s latest State of Credit Unions report, the top five obstacles impeding organizations are:

- Integration with existing systems

- Data and cybersecurity concerns

- High costs

- Data readiness, quality and governance

- Insufficient technical expertise

All of this points to a clear technology problem.

Without a secure, comprehensive, and intuitive platform in your toolkit, you’ll struggle to implement effective digital transformation.

This is where Claromentis can help. Trusted by financial services organizations across the globe, our digital workplace solution is the perfect foundation for enhancing your member experiences.

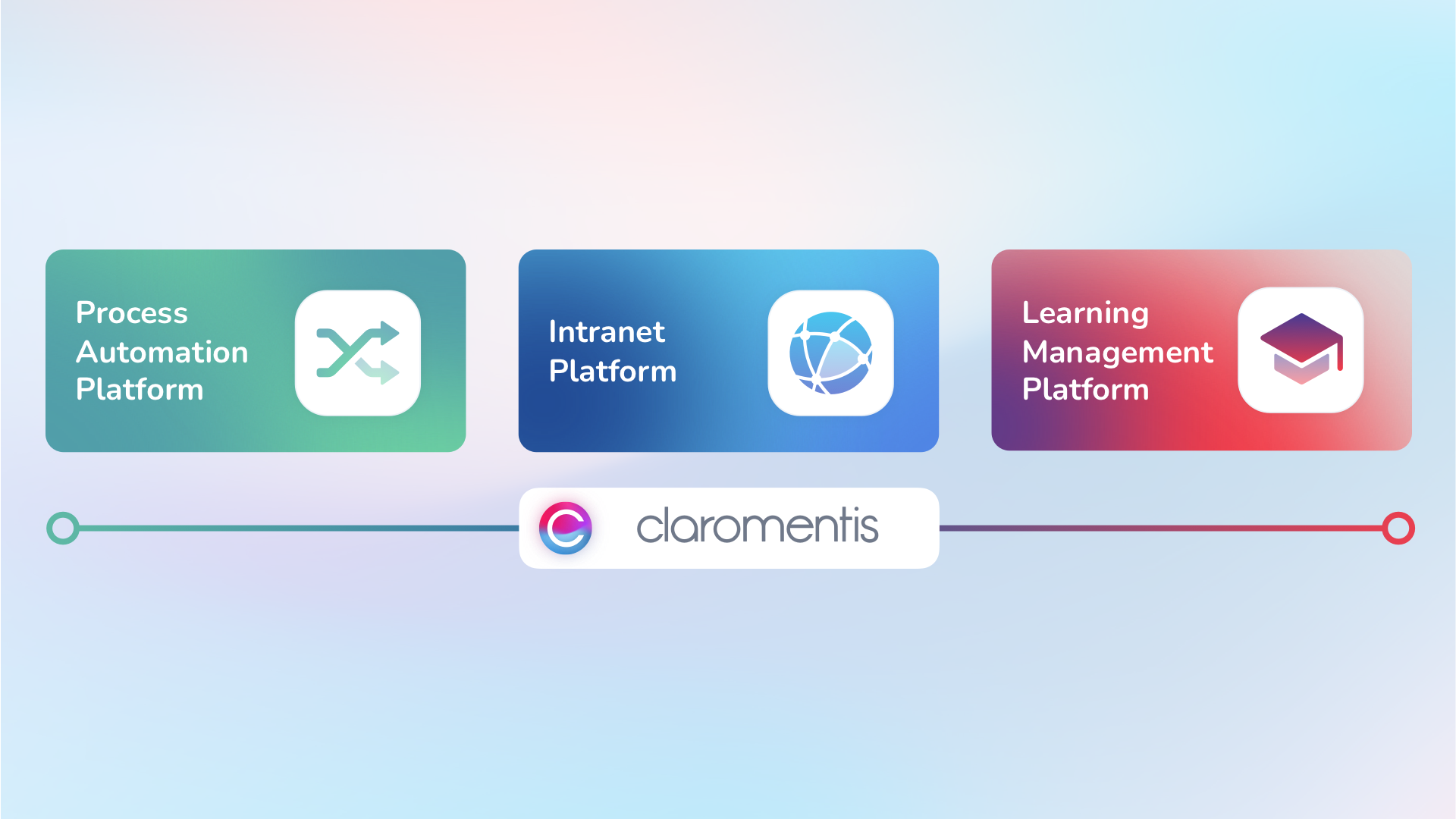

It’s feature-rich, easy to use, and secure by design. With the full integrated solution—comprising three distinct platforms—you can:

- Store easily-searchable and version-controlled documents, policies, customer contracts and more.

- Facilitate cross-team collaboration and knowledge sharing.

- Secure sensitive information with granular permissions, IP-based access controls, two-factor authentication, and single-sign on.

- Integrate third-party applications and data sources to enhance your services.

- Turn your cumbersome manual processes and product applications into slick, automated e-forms and workflows.

- Build secure customer portals for competitive self-service opportunities, interactions, and feedback gathering.

- Create engaging e-learning courses to upskill your employees, improve service quality, and educate your members.

Eager to see what your credit union can achieve with Claromentis? To find out just how transformative our digital workplace solution can be, book a demo with one of our experts today.