According to Statista, digital banking users in the U.S. exceeded 52 million in 2023. And this is expected to increase to 80 million by 2028. That’s almost a quarter of the entire population.

But don’t get too excited about this projection. Remember: an increase in numbers doesn’t automatically equate to an increase in customers. There are thousands of commercial banks and credit unions they can choose from. To stand out from the competition, you need to deliver something new.

This is why an excellent digital customer experience in banking is a critical driver of growth. In fact, banks that focus on optimizing their customer experience grow 3.2x faster than those who don’t.

So, if you want to unlock your potential, provide better service and improve revenue generation you need to understand what your customers want, and how you can provide it.

Customer expectations in banking for 2025 and beyond

Modern customers demand seamless, efficient and personalized banking experiences. In fact, according to Zendesk:

- 72% of customers want immediate service

- 70% expect anyone they interact with to have full context of their needs

- 62% think experiences should flow naturally between both physical and digital spaces

- 62% agree that personalized recommendations are better than general ones

Customers expect their digital banking to be secure, easy to navigate, and efficient. Don’t make things harder than they need to be for them. Because if you do, they will look for an alternative.

Research suggests that failing to provide adequate digital banking services can see customer retention rates drop to as low as 20%. Beyond that, 12% of banking leaders say they have lost up to 40% of their existing customers for failing to adopt a customer-centric approach to their digital operations.

Yet, if you can meet these ever increasing customer expectations you can ensure that they are both satisfied with your service and loyal to your bank.

For example, the Bank of America, now receives more deposits via mobile devices than it does from its branches. And their CEO, Brian Moynihan, states that investing in digital services such as this helped improve customer retention and satisfaction.

“By investing in client capabilities, we make our clients’ lives easier, more efficient and more effective and their satisfaction goes up,” he says. “Our costs then in turn go down because our process will become more automated.”

So, clearly there are advantages to optimizing your digital banking experience. But what are the other benefits of optimizing your banking customer experience?

3 benefits of optimizing your banking CX

Ensuring the best possible digital banking CX for your customers has concrete benefits that contribute to your overall business growth.

1. Increased customer loyalty and retention

Improvements to customer satisfaction and trust mean reduced churn rates. After all, satisfied customers are far more likely to continue using your services. In fact, banking CX research shows that 82% of respondents see CX as the leading driver behind customer loyalty.

2. Boost brand reputation

Loyal, long term customers are more likely to recommend your bank to others. Meaning a good experience can also help increase your customer base.

An excellent real-world example of this is the Wells Fargo mobile app.

According to their CEO, Charles W. Scharf, they updated their mobile offering, making it significantly easier to open accounts. This improved customer experience meant a 40% increase in consumer check accounts, and an increase of 1.5 million customers in 2024.

3. Increased revenue through extra upselling and cross-selling

Providing a consistent, convenient customer experience increases trust, engagement and revenue. This is because a seamless experience makes customers more receptive to additional products and services.

If you can understand your customers, provide sensible and timely product recommendations you will increase revenue and achieve top of wallet status.

4 customer experience trends in banking to watch for in 2025

We have covered what customers are looking for, and the potential business benefits of meeting and exceeding expectations. But, actually achieving this can be difficult. So here are some customer experience trends in banking that you will need to be aware of.

1. Customers want better online and mobile service

According to the American Bankers Association, 55% of consumers prefer to conduct their banking via mobile apps compared to other methods. What’s more, 22% prefer using online banking via their laptop or PC.

Traditional banking methods such as visiting a branch (8%), ATMs (5%) and telephone calls (4%) were in the minority.

This online and mobile banking preference was shared among all generations of customers. From Baby Boomers, all the way to Gen Z. Representing a fundamental shift in how people want to access your services.

So, if you want to compete, you need to have accessible and intuitive online banking available to all via a customer portal. One that can be accessed anytime, anywhere and on any device. One that lets them easily carry out financial transactions while providing personalized financial advice and recommending products and services.

2. Balance between self-service and in-person solutions

Despite the popularity of online and mobile banking solutions, customers feel alienated from their bank.

They are satisfied with the online services, but still value the “human touch”. Showcased by the fact that two-thirds of banking customers still want a branch in their neighborhood, even if they barely ever visit it.

When considering digital transformation, you need to balance convenience with care. Don’t rely too heavily on chat bots, automated workflows and generative AI. Understand when and where it is appropriate to provide personalized, skilled service - either in person or online.

3. Seamless, personalized customer journeys

Did you know that 46% of banking customers feel pressured to buy products that they say benefit the bank more than themselves?

This is the antithesis of good customer service. Don’t lead with the hard sell. You can provide seamless, personalized customer journeys that enable sales that customers actually want.

Not only is this a better deal for customers, but 63% of global banking customers have said they are willing to trade personal data for tailored advice and services.

So people are happy to be sold to, but it needs to be relevant, timely and good value to them. Use online behaviors and data to understand your users and provide the hyper-personalization that many customers actually want.

4. Better, more efficient service with AI

Artificial intelligence in banking is revolutionizing automated processes, customer interactions and improving fraud detection. It is also enabling faster, more personalized and more efficient services. Ones that benefit both banks and their customers.

For example, Cleo, a generative AI-powered money management tool, achieved $150 million in annual recurring revenue in 2024 by helping their 7 million customers develop better financial habits.

In a US survey, 44% of consumers said they were happy with their bank incorporating AI - particularly for fraud detection. But they’re also happy for it to help them access financial services as and when they need them.

Many banks are using generative AI for smarter chatbots, intelligent automated loan application approvals, AML monitoring and contract review.

Here are a few real-life examples:

Bank of America’s AI-Powered Virtual Assistant, Erica

Since launching in 2018, Bank of America’s virtual assistant “Erica” has reached more than 2 billion interactions. Customers engage with Erica approximately 2 million times daily for services like balance inquiries, bill payments, and transaction alerts.

This has led to increased satisfaction and a better customer experience, with 98% of customers saying they get the answers they need within 44 seconds.

JPMorgan Chase’s Contract Intelligence (COiN) Platform

JPMorgan Chase created the COiN platform to automate the review of legal documents, particularly commercial loan agreements.

This has reduced the time required for document review from an estimated 360,000 hours annually to seconds, enhancing efficiency, reducing errors and enabling faster access to loan capital for customers.

HSBC’s AI-Driven AML System

HSBC partnered with Google Cloud to develop an AML system known internally as Dynamic Risk Assessment.

The system screens over a billion transactions each month for signs of financial crime. This helps the bank detect and prevent money laundering activities.

It has also reduced false positives, decreasing unnecessary customer inquiries by 60%. Saving both their fraud teams and their customers a significant amount of time.

How Claromentis helps improve customer experience in banking

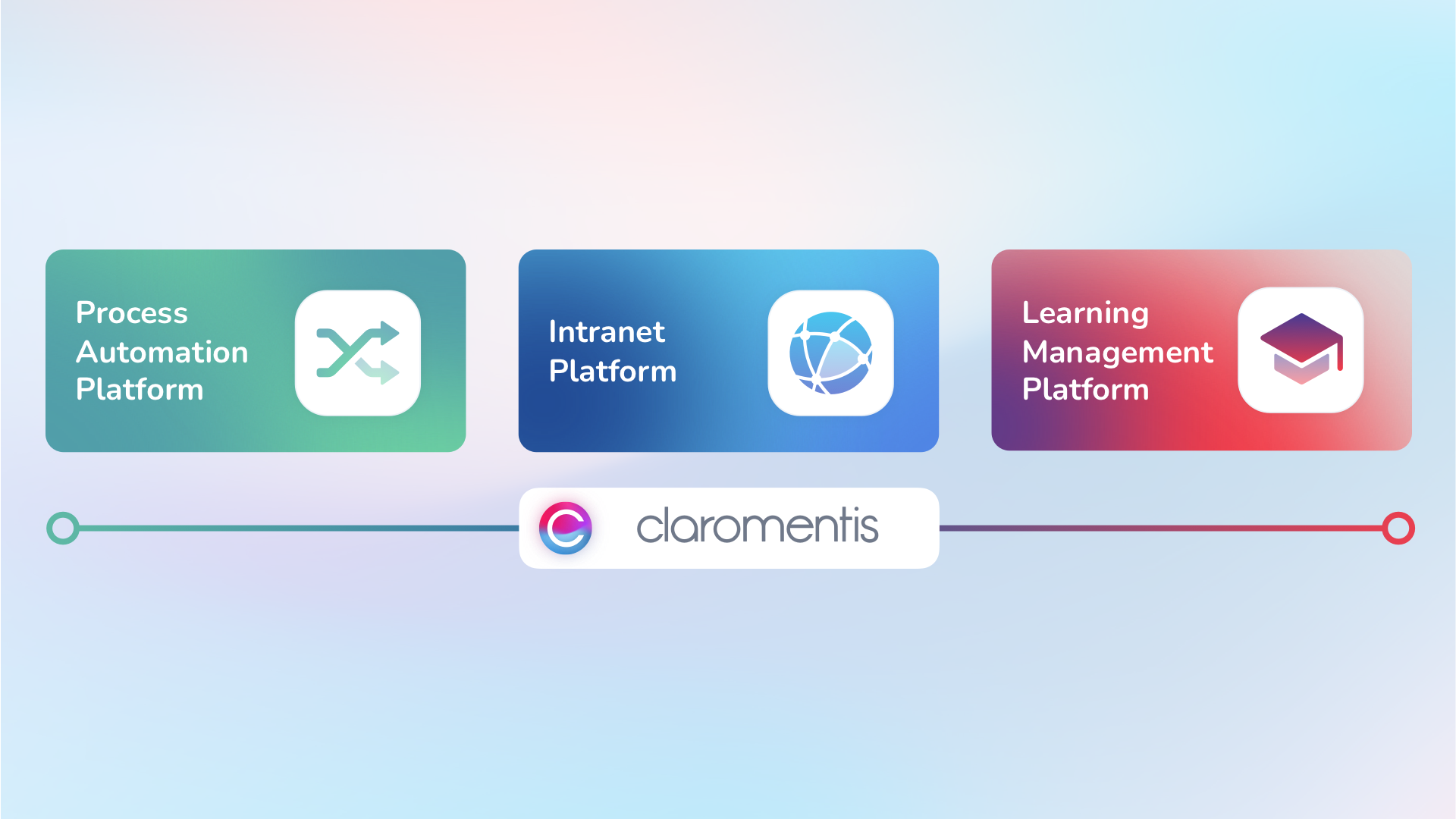

With a secure, customizable platform like Claromentis you can optimize your banking CX to make services more personalized, accessible and efficient.

Here’s how our secure, scalable digital workplace can help your bank improve customer experience:

1. Timely, relevant, personalized recommendations

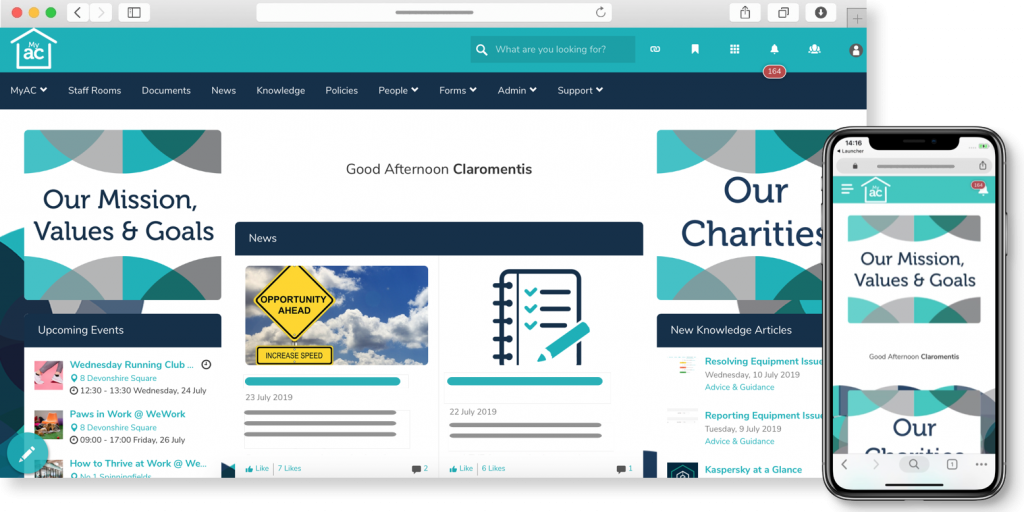

With powerful drag-and-drop page builders, and granular user permissions you can build the ideal banking customer portal.

Claromentis enables you to share personalized pages, offers and recommendations based on your pre-existing user behavior and data. Leading to increased upselling and cross-selling to your existing customer base.

For example, you could use our ‘Announcements’ feature to present a newly available loan rate to all customers that qualify. This would appear as a pop-up when they log in. You can then monitor how many acknowledge the announcement and how many take you up on the offer.

2. Enhanced communications and support with AI assistants and search

Coming in April 2025, Claromentis 10 contains powerful generative AI and AI search capabilities that will revolutionize your customer communications. Here is how your bank can benefit:

- 24/7 Customer Support with our AI Assistant. Provide uninterrupted service and communication via our native AI chatbot “CLAIR” (Claromentis AI Resource). Just provide any relevant documentation and information and the chatbot can help your customers find quick answers to their questions. We think this is so useful, we actually use CLAIR in our own customer portal ‘Claromentis Discover’.

- Save time and effort with Generative AI for News, Images and Articles. Share the latest news and insights with your customers in record time with our generative AI function for articles and blogs. Not only can you create long-form, detailed content quickly and easily, you can also generate the ideal image for any article you publish.

- Simplify policy documentation and enable better understanding with “AI Policy Question and Answer”. If your customers need information, they don’t want to wade through thousands of pages of policy documentation. With Claromentis, they can ask AI and get an answer directly. For example, customers could ask what the standard interest rate is on a 5 year fixed mortgage and get a quick answer without looking through a long document.

Our solution is HIPAA, ISO 9001:2015 and ISO 27001:2022 certified as standard. Also, as we partner with Google Vertex AI your data will not be used to train any AI/ML models without your permission.

That being said, if you still have privacy concerns, our AI capabilities can easily be turned off within any Claromentis instance.

This means we are the perfect partner to help you implement effective, efficient and secure AI within your banking customer portal.

3. Efficient, streamlined customer onboarding

Nearly half of users report having trouble navigating online banking sites or apps. Not only that, 76% of all users say their bank does not offer proactive help when they need it.

For many users, this is enough to leave and go to a competitor. So, if you want to keep your customers happy, don’t be stingy when it comes to helping them.

To ensure the best experience and limit frustration, you can provide quick training and “how to guides” using our LMS permission triggers. This feature allows you to gate certain areas of your customer portal until users have completed or read through a quick training guide.

Enable better understanding of your toolset to empower customers to make the most of their banking experience. If you do, they will not only be more satisfied in general but more open to extending their business with you.

4. Easily automate core banking processes using InfoCapture

Our business process automation platform, InfoCapture, can automate your most common processes, such as account opening, closing, deposits and withdrawals and customer inquiries.

Once integrated with your existing systems, you can automate any process via our simple and intuitive e-forms and workflows. As a drag-and-drop process automation system, this means that any team member can build and update customer processes.

When implemented, all your customers would have to do is enter their details into a form and the InfoCapture workflows would take care of the rest. Allowing your team to focus on more specialized, revenue generating tasks while your core processes happen automatically.

5. Seamless, omnichannel access to customer services

With Claromentis, your customer portal is a single, centralized location where users can access everything they need. Even if you provide your services across multiple channels and products.

Our Buttons feature, as well as Single-Sign On capabilities, mean that your users can access any of your products and platforms directly from your portal. Everything is just a click away.

6. Better communication between teams, branches and customers

Whether you use Claromentis as a customer portal, an employee intranet, or both, it serves as a single source of truth for all stakeholders.

Using our news, announcements and discussion rooms applications you can enable knowledge sharing and communication among stakeholders, as well as collaboration between disparate teams and branches.

Claromentis: the banking portal that your customers can count on

Digital banking adoption continues to rise, as do customer expectations. To remain competitive, reduce churn, and grow as a bank, you need to deliver a seamless digital customer experience.

Claromentis is the secure, scalable and customizable solution that can help you do this.

Our three-in-one digital workplace enables you to create the ideal customer portal. One that balances both security and the user experience to provide efficient, intuitive and engaging banking services.

Book a demo today to see our solution in action and discover how Claromentis can transform your customer experience.