For many financial services institutions, the process of choosing a new intranet is riddled with complexity.

There are two main reasons for this; one, the industry’s continued reliance on inflexible legacy technology; and, two, strict regulatory obligations, such as the GDPR. Because of these challenges, cloud-based intranet platforms are either unsuitable or too complex to deploy.

Is this the case for your business? If so, you’ll no doubt be on a quest to find a self-hosted alternative instead.

In this article, we’ll help you choose the best on-premise intranet for your financial institution.

Determining your platform and feature requirements

With SaaS continuing to reign supreme in the intranet software market, your options for an on-premise alternative are few and far between.

However, this doesn’t mean you should settle for less. It’s integral you find a solution that doesn’t just adhere to your strict standards, but makes a tangible difference to your people, processes and customer experiences.

When weighing up your on-premise options, consider the following:

- Does it provide the features you’d expect from an intranet? Most employee intranets will offer a suite of internal communications, enterprise social networking and collaborative document management tools. However, some vendors will provide additional platforms and features – such as learning management, business process automation and project management tools. If you’re looking to maximise your ROI or consolidate your tech stack, opting for a complete digital workplace platform may be the best move.

- Is the intranet intuitive and easy to get to grips with? You won’t be able to reap the rewards of your new on-premise intranet if your employees find it too unwieldy to use. To avoid any change management problems that could hinder your processes and customer services, it’s important to find a platform that’s intuitive for everyone. We’d recommend choosing a platform with no-code, drag and drop functionality to ease the learning curve.

- How secure is the platform? Your intranet platform for financial services should offer built-in security controls to help you mitigate unauthorised data access, such as: permissions, IP-based access controls, two-factor authentication, application audit logs and more.

- Will it help you comply with your regulatory requirements? Most financial services institutions are required to comply with strict data protection regulations, as well as KYC and AML measures. Some on-premise intranets will contain dedicated features to help you track your obligations, monitor compliance and document your audit procedures.

For more advice on how to find the right intranet, take a look at our in-depth 23-questions blog.

Choosing an on-premise intranet for financial institutions: 7 technical considerations

Beyond features and services, you’ll also want to investigate your vendor’s technical support and hosting requirements. How will they deploy your on-premise intranet? And does that match your IT team’s expectations and requirements?

Determining this criteria before you finalise your partnership will ensure a smooth installation and onboarding process.

1. Does the vendor adhere to strict security standards and data regulations?

Although an on-premise intranet platform will give you enhanced control over your data and its security, you’ll still need to vet your vendor. After all, any vulnerabilities in their intranet framework and services may impact your security posture, too.

Partnering with an on-premise intranet provider that follows stringent data security regulations and standards, such as the GDPR and ISO 27001, will provide additional reassurance.

2. Do they have experience working with financial institutions like yours?

While this isn’t strictly a technical requirement, it does lead on from our previous point – and it’s a step you can’t afford to miss.

A reputable on-premise intranet vendor should have readily available case studies, detailing their work with similar financial services organisations. They should also direct you to relevant customer reviews from trusted software marketplace websites, such as G2.

3. Are they transparent about the share of responsibilities?

When purchasing an on-premise software, incurring some security and maintenance responsibilities is a given. That being said, for the sake of clarity, your vendor should clearly outline which tasks in particular lie with you.

Your responsibilities are likely to include:

- Keeping your infrastructure up to date (if you’re using your own infrastructure)

- Setting up your backup and disaster recovery procedures

- Implementing anti-virus software on your servers

- Configuring on-premise firewalls

- Ensuring your servers have enough space to accommodate the intranet

4. Is the intranet compatible with your systems?

Your intranet vendor should provide a compatibility matrix, detailing the key requirements you’ll need to run the software seamlessly in your environment. At Claromentis, we can operate our on-premise intranet using MySQL or MSSQL – with the addition of a few third-party services.

5. Are they able to help you with the on-premise installation?

In some cases, vendors can take the installation process off your hands. This can free up your technical teams for more critical tasks.

At Claromentis, we offer this service for any MySQL installations. So long as you’ve installed and patched your operating system, we can take the reins and install the necessary third-party services on your behalf.

6. Can they host the intranet in a load balancing environment?

Does your financial institution have multiple branches and a high headcount? If so, a combined web/database server installation may lead to performance issues. This, in turn, can result in reduced productivity across your teams.

If you have over 500 users, we’d recommend hosting your intranet in a load balancing environment instead. This allows you to scale your intranet horizontally as your user base grows, as well as gain failover protection in the event of a server failure.

At Claromentis, we can support both types of hosting. For load balancing, we just need a few key details from your organisation to get started:

- The total number of users that will have access to your intranet system.

- The expected number of concurrent users (users logging in and actively using applications at the same time). If you're unsure about this, we can estimate this for you based on your total number of users.

- The anticipated size of documents (in GB) that you’ll upload to the intranet within the first 12 months.

7. Can they integrate with your existing user directory and identity providers?

The ability to integrate with your user directories and identity providers will streamline the user onboarding and sign-on processes.

At Claromentis, we can:

- Connect directly to your user directory via LDAP or LDAPS protocols.

- Integrate with Windows Authentication.

- Connect with any SAML 2.0 provider.

Claromentis: an on-premise intranet that drives results

With over 90% of the financial services industry still relying on legacy systems, it’s no wonder on-premise intranets are non-negotiable for many firms.

In many ways, this eases the decision process. With fewer vendors to choose from, you can focus on finding a provider that offers the hosting, security and feature requirements that’ll benefit your organisation the most.

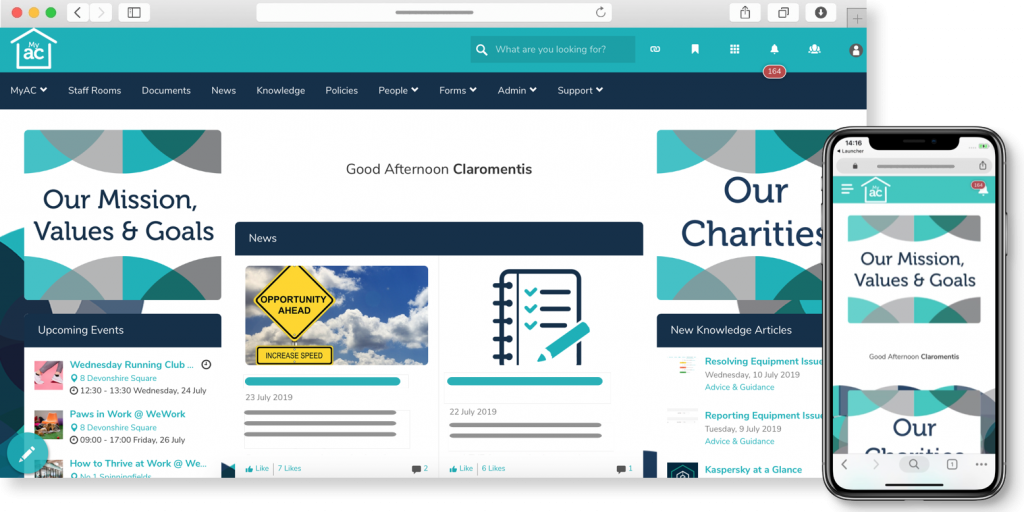

At Claromentis, we can host our secure, feature-rich intranet in the cloud or on-premise. Our solution comes with four powerful platforms built-in (and at no additional cost), as well as a range of services to help you get the most out of your investment, including:

- On-premise installation support

- Customer support and training

- Custom application development

- Design and development

If you’re interested in learning more about our on-premise intranet for financial institutions, book a quick discussion call with one of our experts. We can talk you through platform features, pricing, security and more.